This evaluation helps them make critical decisions on whether or not to continue investing, and it also determines how well a particular business is being run. Investors who are looking for investment opportunities in an industry with capital-intensive businesses may find FAT useful in evaluating and measuring the return on money invested. Learn more ratios in CFI’s financial analysis fundamentals course! How Useful is the Fixed Asset Turnover Ratio to Investors?

This can only be discovered if a comparison is made between a company’s most recent ratio and previous periods or ratios of other similar businesses or industry standards.įixed assets vary significantly from one company to another and from one industry to another, so it is relevant to compare ratios of similar types of businesses. There is no exact ratio or range to determine whether or not a company is efficient at generating revenue on such assets. It indicates that there is greater efficiency in regards to managing fixed assets therefore, it gives higher returns on asset investments. High RatioĪ high ratio, on the other hand, is preferred for most businesses. Although not all low ratios are bad, if the company just made some new large purchases of fixed assets for modernization, the low FAT may have a negative connotation.Ī declining ratio may also suggest that the company is over-investing in its fixed assets. This is especially true for manufacturing businesses that utilize big machines and facilities. When the business is underperforming in sales and has a relatively high amount of investment in fixed assets, the FAT ratio may be low. Indications of High / Low Fixed Asset Turnover Ratio Low Ratio All of these are depreciated from the initial asset value periodically until they reach the end of their usefulness or are retired. They are subject to periodic depreciation, impairments, and disposition.

These include real properties, such as land and buildings, machinery and equipment, furniture and fixtures, and vehicles.

#Fixed asset turnover download

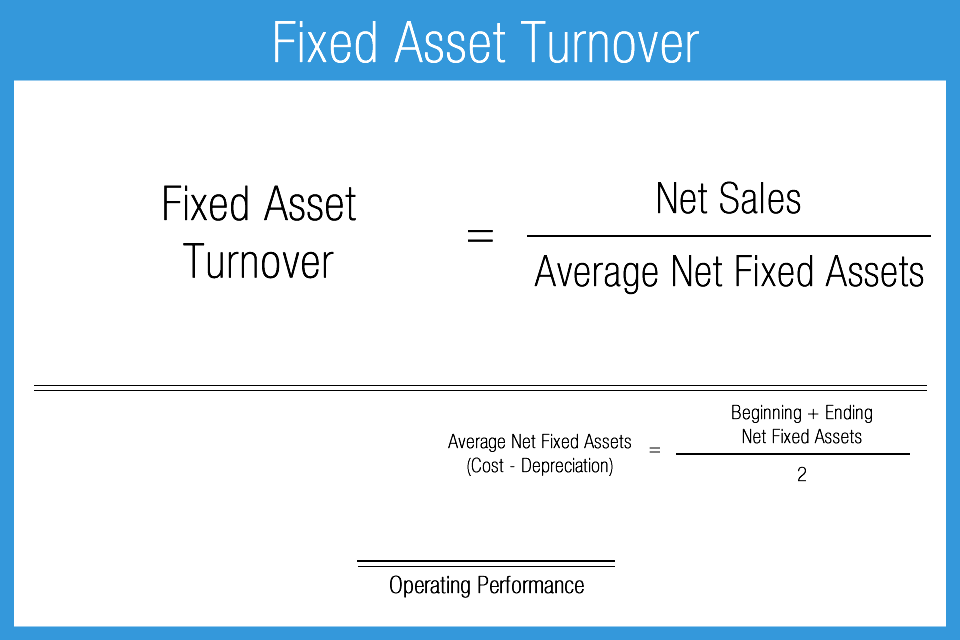

Download the Free TemplateĮnter your name and email in the form below and download the free template now!įixed assets are tangible long-term or non-current assets used in the course of business to aid in generating revenue. The average net fixed asset figure is calculated by adding the beginning and ending balances, then dividing that number by 2. Based on the given figures, the fixed asset turnover ratio for the year is 9.51, meaning that for every one dollar invested in fixed assets, a return of almost ten dollars is earned. Its net fixed assets’ beginning balance was $1M, while the year-end balance amounts to $1.1M. To determine the Fixed Asset Turnover ratio, the following formula is used:įixed Asset Turnover = Net Sales / Average Fixed Assets Example Calculationįisher Company has annual gross sales of $10M in the year 2015, with sales returns and allowances of $10,000. Learn more ratios in CFI’s financial analysis fundamentals course! Fixed Asset Turnover Ratio Formula This ratio is often analyzed alongside leverage and profitability ratios. Generally, a higher fixed asset ratio implies more effective utilization of investments in fixed assets to generate revenue. The net fixed assets include the amount of property, plant, and equipment, less the accumulated depreciation. This ratio divides net sales by net fixed assets, calculated over an annual period. Updated FebruWhat is Fixed Asset Turnover?įixed Asset Turnover (FAT) is an efficiency ratio that indicates how well or efficiently a business uses fixed assets to generate sales.

0 kommentar(er)

0 kommentar(er)